Gareth Southgate stepped down as England manager after missing out on European glory. With the 53-year-old no longer in a footballing role, The Asterisk explores Gareth’s other streams of income.

Besides the millions he has raked in while working for the Football Association (FA), Gareth has also set up lucrative businesses in recent years.

Similar to his England stint, not everything has been rosy on the entrepreneurial side. One of his investments caught the eye of the tax authorities.

Let’s dive into Gareth’s business interests, the numbers behind his ventures, and the challenges the former Middlesbrough chief has had to encounter.

FHS Promotions Limited

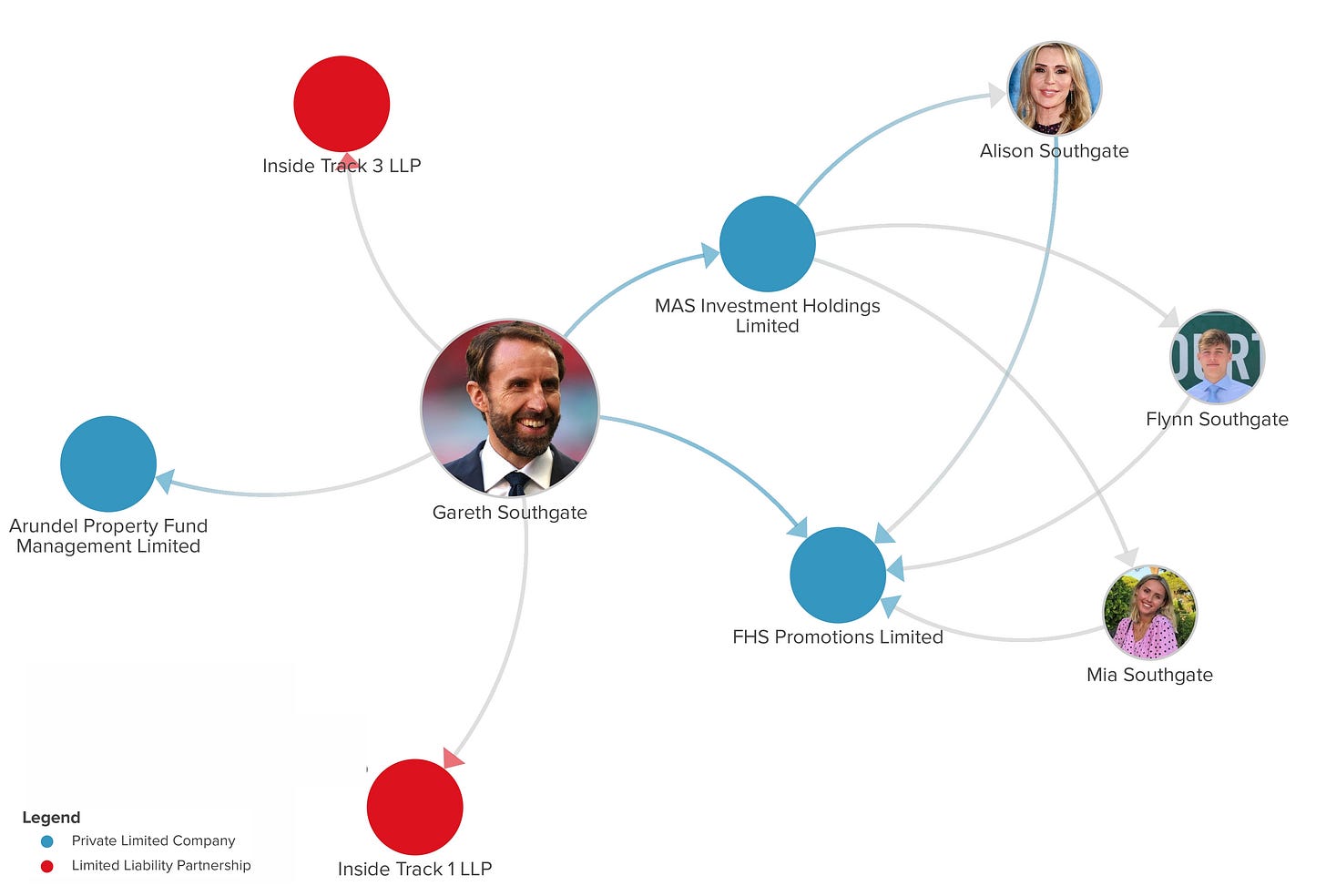

FHS Promotions Limited is one of the most valuable companies in Gareth Southgate’s portfolio.

The company engages in activities with his image rights and was established in 2017.

The former England manager serves as the director of the firm along with his wife, Alison.

Gareth has significant control of the company (75 shares), while Alison owns 15 shares. His children, Flynn and Mia, are also a part of the company and have five shares each.

The company’s net assets dropped by half a million last year.

FHS’ net assets are valued at £124,249 according to the company’s latest financial filings for the year ended 31 August 2023. In 2022, net assets were worth £0.7 million.

Current assets saw a 57% drop in value. In 2023, they were worth just over half a million compared to £1.3m the previous year.

“It appears as if money's being taken out and therefore that's reduced the overall value of the assets,” football finance expert Kieran Maguire told The Asterisk.

“If you’ve got £600,000 in the business and you want to take it out for another purpose, you take it out of that company,” he explained.

The finance and accounting professor at the University of Liverpool said that the money could’ve been taken out to distribute profits to the shareholders, repurchase its own shares, or pay off existing debts.

MAS Investment Holdings Limited

Gareth set up MAS Investment Holdings Limited, a company that deals with the buying, selling, renting, and management of real estate, in 2019.

Both Gareth and his wife serve as directors. The company follows a similar shareholder structure to FHS in terms of personnel. With 50 shares, Southgate has significant control of the firm. However, the kids own more shares than Alison.

While the value of FHS’ net assets dropped, MAS witnessed a positive trend.

The company has net assets valued at £65,962, according to its latest financial statements for the year ended April 2023.

The firm has possibly invested substantial amounts in property but has also borrowed at the same time, according to Maguire.

“If you take a look at the net assets, it hasn’t changed a huge amount,” he analysed.

The company is doing alright given that it has doubled the value of its net assets, he said.

Since MAS has invested a lot in real estate, it is likely that Southgate has either taken out loans or has used his own money to purchase new properties, explained Maguire.

Net assets nearly doubled last year from £33,474 in 2022.

The value of the properties that he owns saw an even bigger growth. MAS declared fixed assets worth £3.7m in 2023, up 212% from £1.2m in the previous year.

Current assets’ value fell to £269,348 from £648,978 in 2022.

Two charges issued against MAS

Two financial institutions have recorded charges against MAS which are outstanding, according to Companies House.

On 21 May, Hampshire Trust Bank issued a charge over two London properties that Gareth has used as collateral for a loan.

Charges like these are fairly common in the business world, according to Maguire. It serves as a legal claim against the properties ensuring that the financial institutions have the right to take ownership should Gareth fail to repay the loans.

He also has several properties in London, Manchester, and Salford as collateral, according to a similar charge dated 3 July 2023.

The loan provider in this case is Together Commercial Finance Limited.

The loans that Gareth has taken out on the properties are essentially mortgages with the intention of generating profits, according to Maguire.

“If you want to increase your real estate portfolio, unless you are very wealthy and you’ve got a lot of spare cash, you put in an amount of money, you go to a financial institution and you borrow as well.

“You then put that money into the property. You either rent it out or you improve it and sell it on.

“It’s no different to any property developer borrowing money as part of the funding to build up properties which they can then go on to sell and make profits from real estate,” he said.

Arundel Property Fund Management Limited

Southgate has also been a director of Arundel Property Fund Management Limited, a real estate investment and management firm, since 2007.

He has owned five shares since 2013, according to Companies House documents.

The company has current assets valued at £4,121.

Inside Track 1 LLP and Inside Track 3 LLP

Apart from being the director of multiple companies, Southgate has invested in Limited Liability Partnerships (LLP).

An LLP is a business structure where the members or partners run a business together and share the profits. If the business gets into financial trouble, the members don’t risk losing more money than they invested.

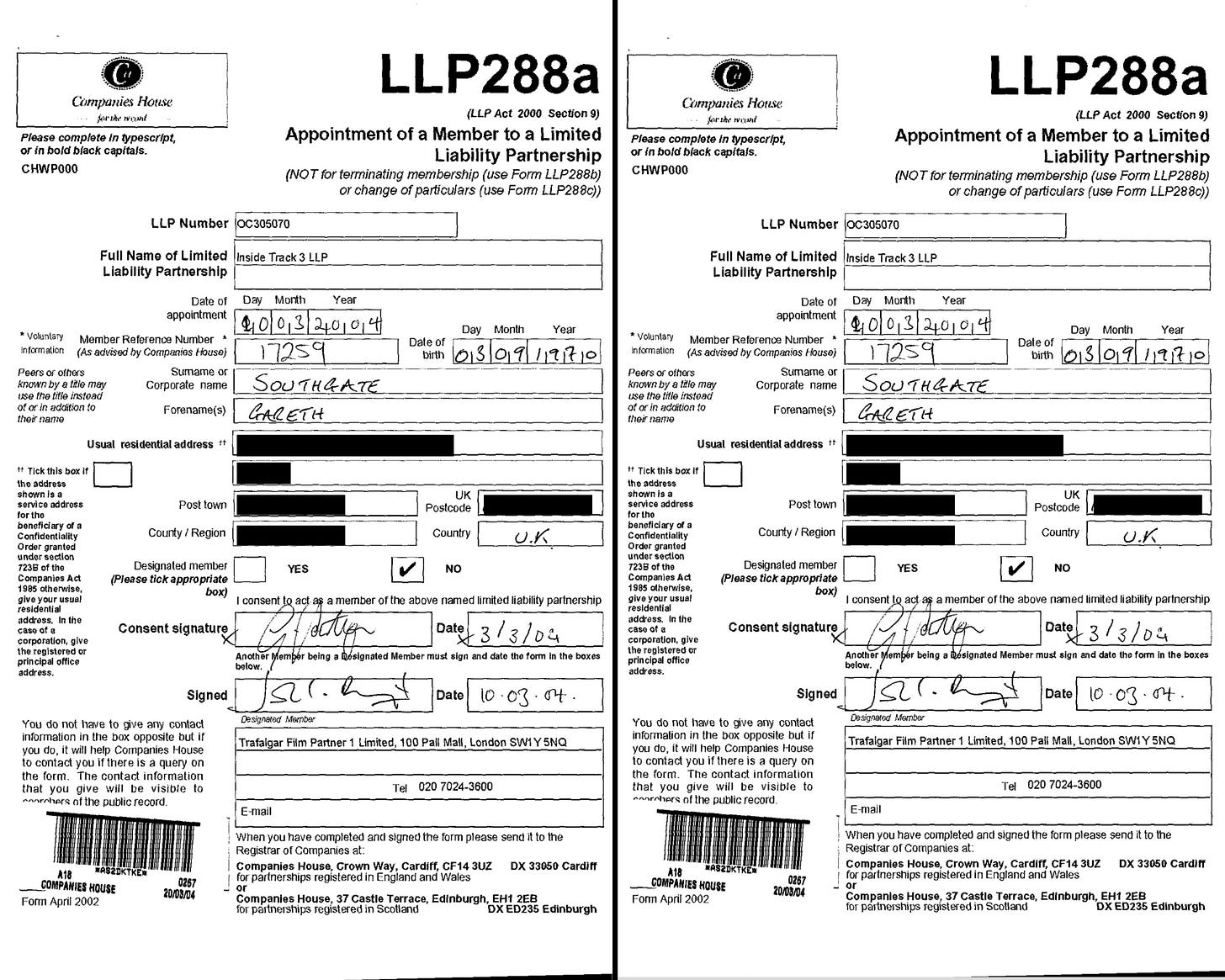

Gareth has been a member of two LLPs, Inside Track 1 LLP and Inside Track 3 LLP, since 2004.

The core business of both partnerships is to produce high-quality movies with the potential to be profitable across all media, according to their financial accounts.

The film partnerships were set up by Ingenious Media Group that has co-produced blockbuster movies such as Life of Pi and Avatar.

Inside Track 3 LLP, along with other Ingenious entities, were recently caught up in a tax row with HM Revenue and Customs (HMRC).

Ingenious were accused of creating fake losses worth £1.6 billion so that its investors could claim tax relief.

In July 2019, the Upper Tribunal court stated that the Ingenious entities were not actively doing business and therefore not aiming to make a profit. The ruling meant that the companies would be taxed as corporations and not partnerships.

In 2020, the government enacted the Finance Act 2020. It ensured that LLPs will be taxed as partnerships if their filings indicate the intention of making a profit.

Inside Track Productions LLP, which acted as the lead case for the Ingenious entities, filed its tax returns in 2020 and 2021 based on the original ruling.

The Court of Appeal reversed the Upper Tribunal’s decision in August 2021. It ruled that the LLP was trading with the aim of making a profit, hence the entity should be taxed as a partnership.

All LLP members, including Gareth Southgate, will be taxed on their share of the profits.

People involved in Inside Track likely invested their money in good faith, according to Maguire.

“They didn’t realise what was necessarily taking place in terms of how that money was invested on their behalf,” he said.

Maguire said that Southgate had a fallout with his former business advisor who treated the ex-England manager ‘badly’.

Inside Track 1 LLP reported turnover of £40,881 in 2023. Profit for the financial year before members' remuneration and being distributed among them is £23,763, a 33% drop compared to the previous year.

Members at Inside Track 1 have invested £73.4 million into the LLP over time, whereas £119 million has been invested into Inside Track 3.

Inside Track 3 LLP doubled its turnover in 2023.

Revenue rose from £0.4m in 2022 to £0.9m last year.

Profits made by the business before paying the members and being shared among them was still nearly £0.9m after administration expenses.

‘Gareth’s a smart guy’

Maguire believes that the former England manager has wisely invested in projects and it is a reflection of long-time industry involvement.

“Gareth Southgate’s a man who’s been involved in the industry for a long time, so you’d expect there to be significant figures as a result of that,” said Maguire.

“It reflects the fact that he’s a smart guy and he’s put his money into projects which he feels he’ll get a return on,” he added.